FAQ > Data Entry On The Worksheet

How can I split a transaction?

SimplifyEm Property Management Software provides a feature that allows you to split income and expense transactions (except rent received) across multiple properties, IRS categories, and time periods. For instance, if you send $5,000 to your property manager to cover expenses for two different rental properties, you can divide and allocate the specific amounts to each property. However, please note that transactions cannot be split across different calendar years.

To split a transaction, follow these steps:

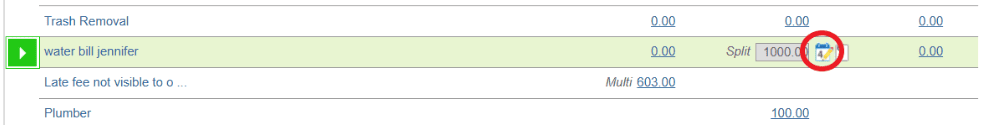

- Go to the Property Worksheet: Start by navigating to the property worksheet where the transaction is recorded. Make sure you’ve selected the correct property and tenant to locate the transaction.

- Open the Transaction: Find the transaction you want to split. Click the “Edit Transaction” icon next to it to open the “Record” window, where you can modify the details of the transaction.

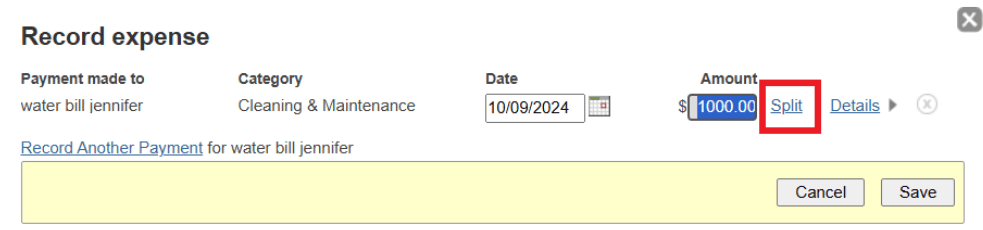

- Enter the Split Amount: In the “Record” window, enter the total amount of the transaction in the amount field. After entering the amount, click the “Split” link next to it. This will allow you to divide the transaction into multiple parts.

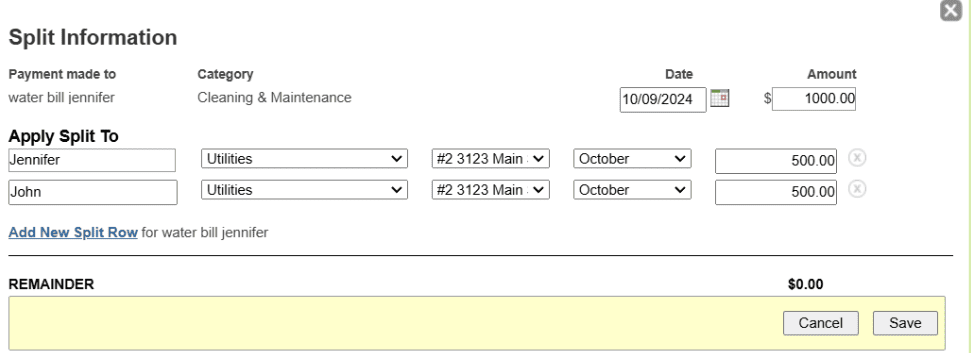

- Split the Transaction: Clicking the “Split” link will open the “Split Transaction” window. Here, you can specify how to divide the total transaction across different properties, IRS categories, or time periods. You can input the specific amounts for each part of the split. For example, you can allocate $500 to one property and $500 to another property.

- Save the Changes: After specifying the split amounts, save your changes. The software will automatically allocate the amounts to the appropriate properties or categories, making it easy to manage your transactions across multiple areas.

By following these steps, you can effectively split and track income or expense transactions, ensuring your records are organized and accurate across different properties.